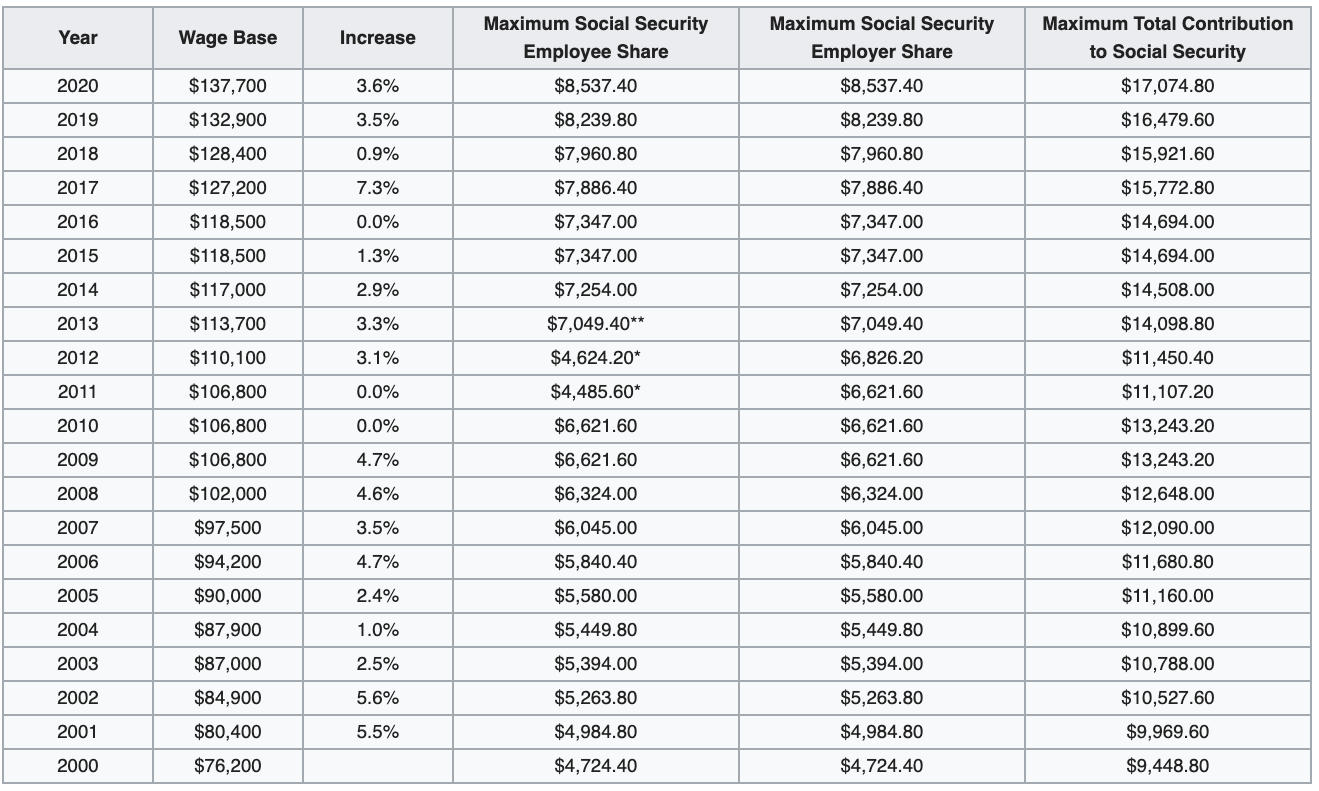

Social Security Withholding 2025 Rate - What Is Max Social Security Withholding 2025 Kate Sarine, Social security taxes in 2025 are 6.2 percent of gross wages up to $168,600. Social Security Limit 2025 Withholding Jandy Lindsey, What is the social security withholding rate for employees in 2025?

What Is Max Social Security Withholding 2025 Kate Sarine, Social security taxes in 2025 are 6.2 percent of gross wages up to $168,600.

Social Security Tax Limit 2025 Withholding Issie Josefa, Employees and employers split the total cost.

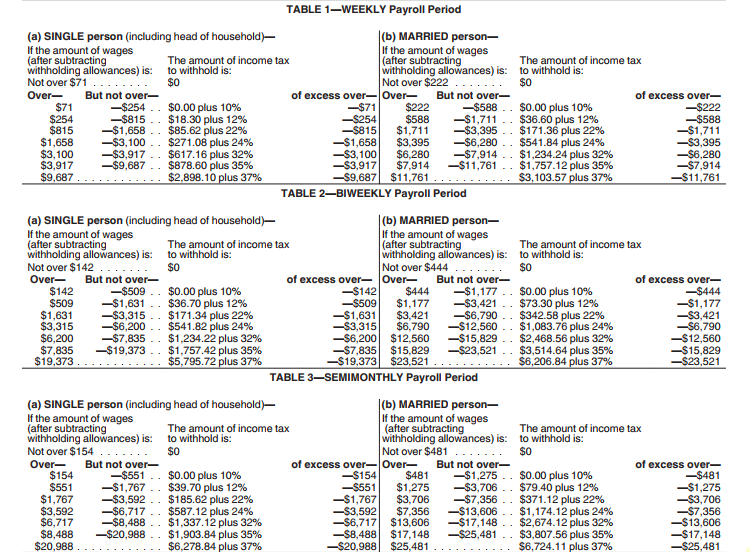

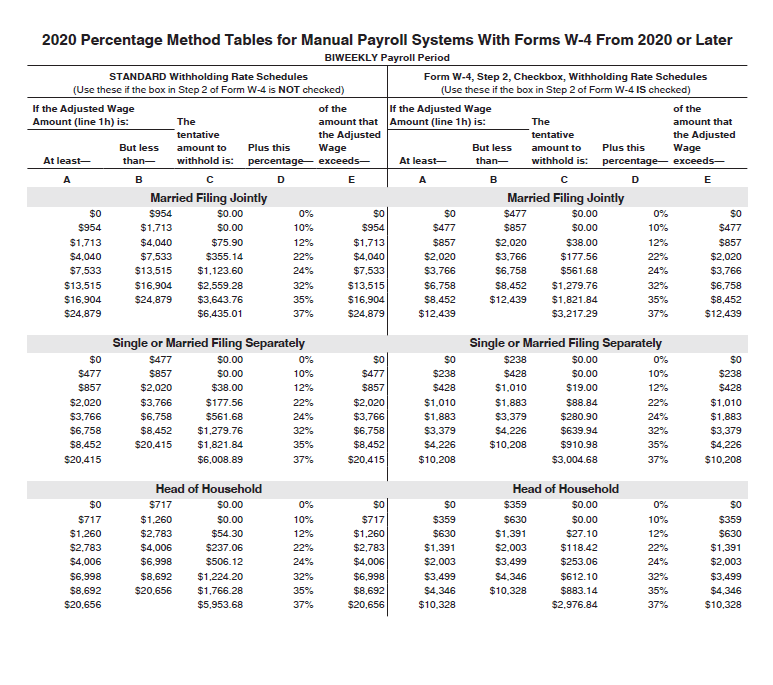

Maximum Social Security Tax 2025 Withholding Table Amil Maddie, 29 rows tax rates for each social security trust fund.

Social Security Max 2025 Contribution Bobby Christa, Your employer also pays 6.2% on any taxable wages.

Social Security Tax Limit 2025 Withholding Chart Andra Blanche, In 2025, 7.65% is the combined rate for social security, at 6.20% up to the wage base limit of $168,600, and medicare at 1.45% without a limit.

2025 Max Social Security Tax Withholding Rate Faye Orelia, Social security taxes in 2025 are 6.2 percent of gross wages up to $168,600.

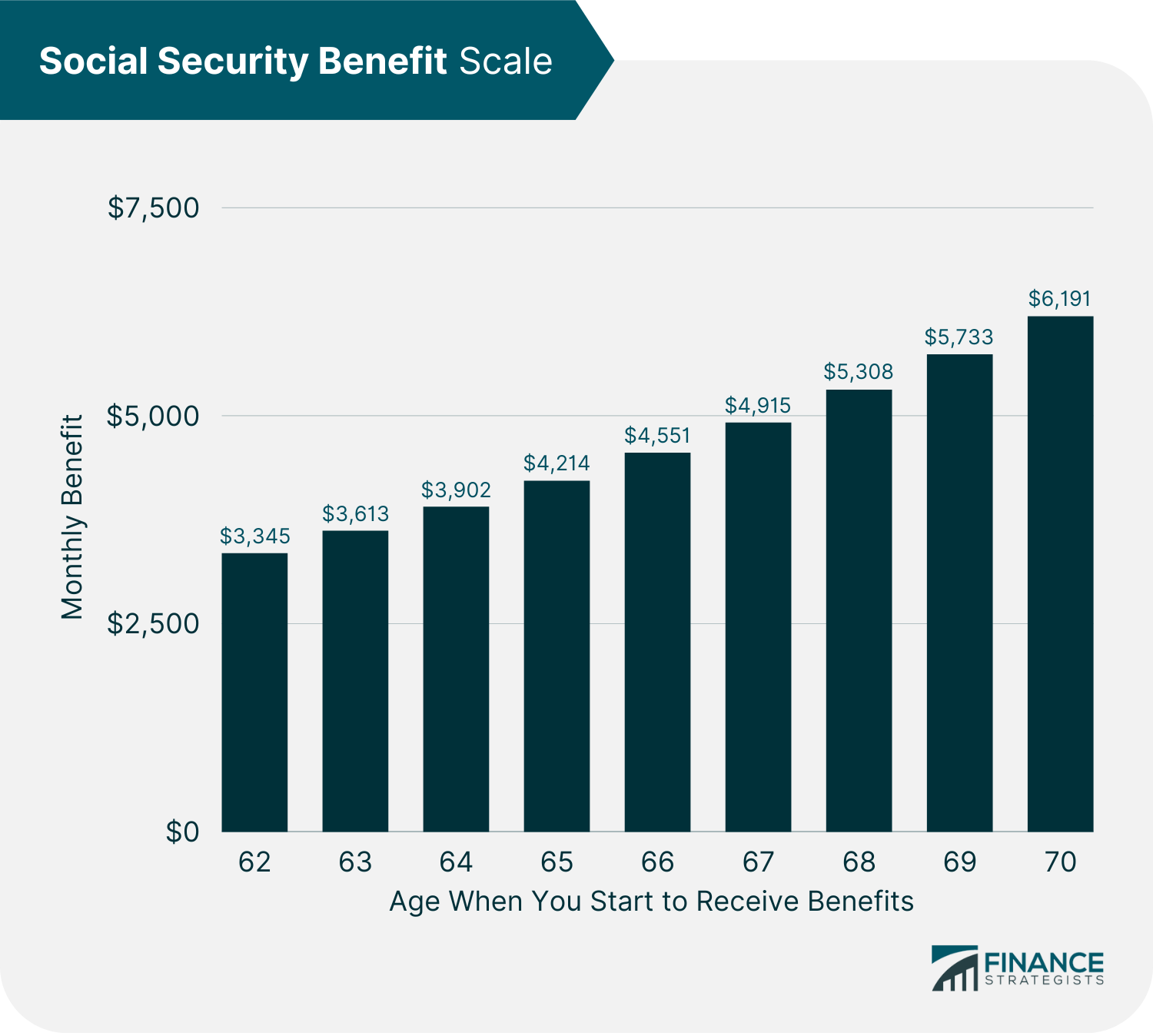

2025 Max Social Security Tax By Year Chart Conny Diannne, The social security wage cap is $168,600 in 2025, up from $160,200 in 2023.

Social Security Withholding 2025 Rate. If you are already receiving benefits or if you want to change or stop your. In 2025, 7.65% is the combined rate for social security, at 6.20% up to the wage base limit of $168,600, and medicare at 1.45% without a limit.

The social security withholding rate is 6.2% for employees in 2025. In 2025, 7.65% is the combined rate for social security, at 6.20% up to the wage base limit of $168,600, and medicare at 1.45% without a limit.

2025 Max Social Security Tax By Year Usa Patsy Bellanca, The social security withholding rate is 6.2% for employees in 2025.